I agree with that.

Maybe I don’t have a big enough picture, but I feel like the opt-in framework is the only safe one.

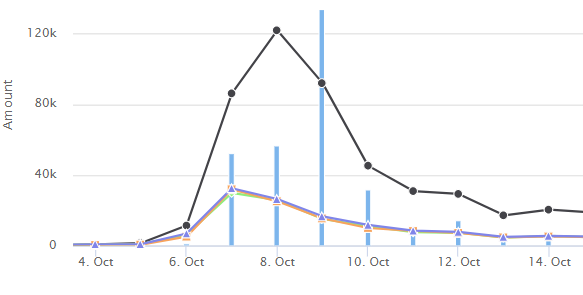

From the DPI Uniswap LP token information ($876.01 | Uniswap DPI/ETH LP (UNI-V2) Token Tracker | Etherscan) it looks like the daily volume was above 80k LP tokens per day for three days in a row. The total supply of DPI UNI LP tokens is around 70k. While I am not sure how to interpret it, it looks like A LOT has been going on at the start of the Index Coop launch. I don’t see why such a spike in activity could not happen again, hence locking even 10% of all of the $DPI looks like a risky move to me.

Here are the txs from and to the staking contract around the same dates : $876.01 | Uniswap DPI/ETH LP (UNI-V2) Token Tracker | Etherscan

There are probably 500 holders or so of the $DPI index. As we saw previously in DeFi, capital can move extremely quickly when controlled by such a low amount of holders.

A viable solution could be the following :

- A new “locked staking” contract where users can put their DPI to accrue both in-kind interests and $INDEX rewards.

- A new “locked staking” contract where users can put their UNI LP DPI (to keep the liquidity incentive going) to accrue both in-kind interests and $INDEX rewards.

- We keep the existing UNI LP DPI staking contract with $INDEX rewards.

This way, the $DPI are set as productive assets on an opt-in basis, with a double incentive to take the risk (interests accrual + $INDEX rewards). On the other hand there would eventually be a delay between a withdrawal request and an effective withdrawal, or more simply a cap/limit on the staking contract.

Keeping the original $INDEX staking contract in parallel means the original promise of it is still fulfilled with no extra risk for those you “bought” that narrative.

Adding an extra LP UNI “locked” staking contract with interests accrual and $INDEX rewards allows to boost returns for those who want to continue to be an LP but still want to accrue interests. It also avoids the situation where LPs are suddently descentivized to provide liquidity, should interests accrual in the “locked staking” contract become greater than LP $INDEX rewards.