With the passing vote on IIP-54, I’ve been looking at backtesting the behaviour of BED:ETH pair on uniswap.

My goal is to try and understand how much the prices diverge over time between rebalences as this will be a key consideration in setting liquidity ranges on Uniswap v3. Instinctively I think BED:ETH should be pretty stable, but I wanted some data to work with.

Data was downloaded from Coingecko (in both USD and ETH terms) and then manipulated in a spreadsheet.

This analysis assumed that there were no significant spikes in ETH:DPI or ETH:BTC prices between thaes dailty checkpoints.

This is my progress to date:

Note, most of this data is presented in ETH price terms as that is what the liquidity pool will be. It always takes me some time to move from thinking about USD to ETH value, but it is well worth this mental juggling to understand the liquidity pair.

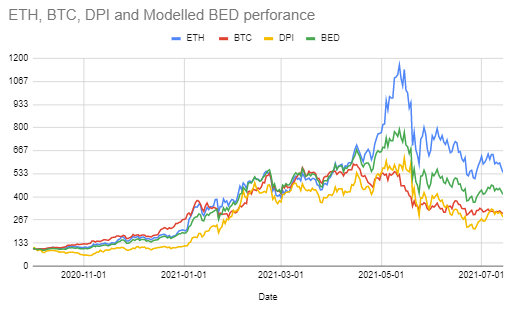

The first chart looks at the components and a simple 1/3 ETH, 1/3 DPI and 1/3 wBTC fund held (without rebalencing) since the start date all prices in ETH. Overall the chart isn’t that informative with DPI and wBTC underperforming ETH over the last 10 months and BED being intermediate.

Chart 1

Overall, it looks like the modelled BED has stayed in a range between +0 and -38% vs ETH since creation on 14th September.

This indicates that a very large liquidity range may be required. However, if we assume that the liquidity will be repositioned, it makes sense to look at a range of start dates.

If we just look at buying BTC, ETH, & DPI and hold them cold on the 1st of each month, the chart for the untokenised BED looks like this ugly mess:

Chart 2

This is actually more worrying as it implies that there are times when a static (non-rebalancing) BED can undergo significant price changes vs ETH (e.g. 01Mar21 +25% to -25% in 10 weeks). Such a profile implies that we may need large TLV in the pool, or be repositioning it on a frequent basis.

Following this, I looked at what would happen if we rebalance BED each month.

- 1st October Equal values of wBTC, DETH and DPI were purchased, then the portfolio performance was tracked over the month.

- 1st November the portfolio value is calculated, and then redistributed 1/3 : 1/3 : 1/3 and allowed to run another month.

- Repeat until 14th July 2021.

note, this calculation is not perfect as the recalculation is assumed to happen over 24 hours with no relative price changes - however, the error is expected to be small

Chart 3

Note, this calculation is not perfect as the recalculation is assumed to happen over 24 hours with no relative price changes - however, the error is expected to be small

Compared to the first figure, the rebalancing has a few impacts starting from the 1st October 2020:

- BED actually out performed ETH in March

- The drawdown in May was slightly better for the rebalanced BED

Overall the maximum drawdown expected is reduced slightly to ~40% over 10 weeks.

The fourth chart assumes that BED is rebalanced every month (on the 1st) and then looks at the price divergence over the next 40 days (Reblanences may not happen on exactly the same date each month, so adding a few days extra allows us to consider this).

Chart 4

This indicates that starting on any particular 1st of the month, the price divergence is between -30% and +15% over the following 40 days. IN addition for the first 7 days, the range is -12% to +8%.

However, while this is pretty encouraging for positioning/repositioning liquidity, there is a possibility that there are more rapid changes hiding in the middle of the data. So, I repeated the process starting every Monday…

Chart 5

As expected it takes some time for the prices to diverge with at least 4 days to exceed a 10% change and 15 days to pass 20% (although it’s close to 20% after 8 days in 1 case).

Using the same data it’s possible to build a heat map of when the price moves past a given % from the starting point:

Table 1

I think this is the most useful visualisation. How we can use it depends on what we are trying to achieve:

- Ensure liquidity at all times

- Ensure deep liquidity close to the likely price point for as long as possible

- Allow additional depth for buying BED at launch.

- Maximise fee income for the LP (Were being out of position for short periods may be preferable to being spread too widely).

- Reduce the need to reposition liquidity

For example, a +/- 12.5% range would have been in the range after:

- 15 days 95% of the time

- 40 days 70% of the time

And so on.

I’ll add another post with my thoughts on how we can use this data

Regards

OA