1. Summary

I would like to present DEXI. A mark weighted index focused on capturing the growth of Decentralise Exchanges (DEX) within the DeFi ecosystem. This theme focused index offers exposure of up to 10 different DEXs that meet a defined set of criteria. Unlike any other product on the market, this index offers investors depth and targeted exposure to DEXs, a core pillar of DeFi.

The methodology is simple. To be include in DEXI, a project’s token must meet the following criteria:

Listed as a DEX by DeFi Pulse

Greater than 10% of token supply in circulation

Greater than 100 mil market capitalisation

Greater than 10 mil daily trading volume

Trading minimum 3 months

At this point in time, only 7 projects meet these requirements. With the vision of DeFi growing, projects evolving and creating a niche for themselves; DEXI shall rebalance to include these projects. DEXI will grow with DeFi until all 10 places in the index are filled. Upon containing 10 projects, DEXI is to be periodically rebalanced based on a weighted approach utilising the average circulating market cap for the last 7 days of each month. This methodology is very similar to the DPI product offering of Index Coop.

If any investor was to invest in DEXI and DPI on the 1st November 2021, up until the 7th January 2021, then DEXI would have outperformed DPI by 12.8%.

DEXI + 166.81 %

DPI + 154.03 %

2. Objective

DEXI offers direct theme based exposure to the largest DEXs in the DeFi ecosystem. An opportunity to gain gas efficient exposure to a core pillar of the DeFi ecosystem. DEXI is a tailored product uniquely offering DEX focused exposure via a passive market weight balanced portfolio. All those who have used DeFi know how pivotal DEXs are and how critical ongoing innovation is to retaining/building market share. With a passive index investing approach, an investors by default has a bag full of leaders.

2.1 Size of Opportunity

How large can DeFi grow ? The larger the ecosystem grows, the larger DEXI becomes. DEXs have a revenue stream that traditional finance can understand. Traditional finance companies are all too familiar with how exchanges operate through generating fees through facilitating a transaction between sellers and buyers. This is also a strength for DEXI, uncomplicated by other functions within DeFi, this theme focused index targets project’s with a well understood revenue generating model.

2.2 Differentiation

There are some correlations with DPI, with some projects in both DEXI and DPI. This is likely to always be the case. DPI contains the leaders across the DeFi space and naturally, DEXs will feature on the leaderboard. With a theme based investment product, it is tailored to those that want exposure to a vertical pillar of DeFi rather across a pool of very different projects. DEXs are amongst the most innovative protocols, the UniSwap airdrop and Sushi vampire attack showcases this innovation in 2020. Aggregators are emerging with there own token and Layer 2 solutions shall be a revolutionary in savings fees. Some projects have close ties with wealth managers and uniquely position to capture exposure to other layer 1 ecosystems. With such depth of innovation within DEXs, an investor really needs more than just 1 or 2 leaders in the space. By having depth and DEX theme, which ever project emerge to capture market share, DEXI will capture that growth and increase its exposure in projects that out grow competitors.

4. Methodology

4.1 Index Calculations

A value weight index that is periodically rebalanced at the start of each month. The weighting of each project is proportional to the average circulating supply market capitalisation for the last 7 days of each month by the total worth of all the projects in the index. This methodology is similar to DPI and could be aligned to create simplicity within Index Coop product offering.

4.2 Token Inclusion Criteria

To be include in DEXI a project must first be deemed a DEX by DeFi Pulse. Then it becomes very simple:

Greater than 10% of token supply in circulation

Greater than 100 mil market capitalisation

Greater than 10 mil daily trading volume

Trading minimum 3 months

A project must be of suitable size and offer sufficient liquidity to enable the index to rebalance without significantly influencing price.

The initial 3 months of trading is largely in part to see out any liquidity incentive schemes which could lead saturation in the market over a short period of time. 1inch is currently in this phase.

4.3 DEXI

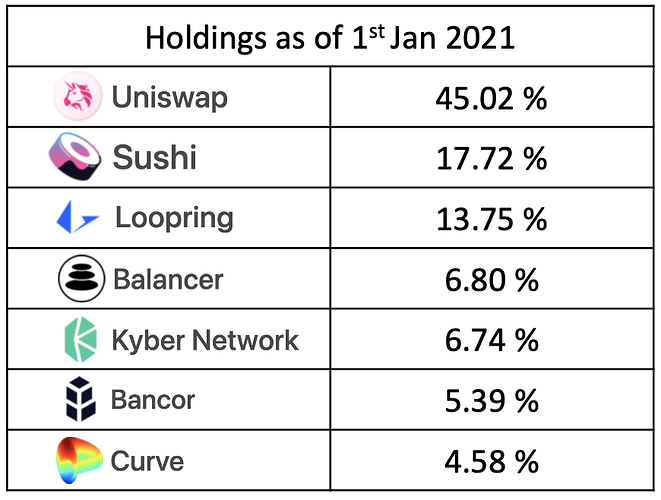

As of the 1st January 2021, based on the methodology outline above, below table details the composition of DEXI.

5. Fees

Fees should be kept simple on what is a very simple index.

The same fee structure as the Metaverse Index, see below for details:

- 0.55% fee on holdings first 6 months, charged per block. This is a subsidized rate initially to incentivize growth of AUM.

- 0.95% after 6 months also charged per block

- 0.3% fee on sale of the index to discourage selling but not arbitrage (should be tuneable so it can be adjusted)

As no precedent has been set I’m happy to be flexible based on feedback/community votes but for this particular index proposal I suggest the following:

- Fees split 50/45/5 between Set team/Index Coop/Proposer (me) for the launch and during any liquidity mining event.

- After the initial launch period (end of liquidity mining or 3 months, whichever comes last) 50/50 split between the index manager(s) and Index Co-op treasury as this will be a community created Index.

- Ideally I would like to see this proposal through to launch and continue to manage the Index thereafter. If it is the same as being a Social Trader then I should have the capacity to do it, if it takes more technical knowledge then the Set team will have to support.

Hopefully the community call to review and discuss.

6. Information

I have prepared a presentation, please see link below.

I am very open to feedback and will add to this post in time.