Summary

Proposal:

Run a three-month incentive campaign to drive usage of the Index Coop Leverage Suite. Distribute 50,000 $INDEX per month from the Index Coop Treasury, starting October 14, 2025, for an initial total of 150,000 $INDEX.

The campaign will operate in two-week epochs. Competition details and reward rules will be published in a following marketing announcement upon a successful vote. Following review of participation and results, the program may be extended for up to three additional months.

Quantities:

-

Monthly allocation: 50,000 $INDEX

-

Initial duration: 3 months (October–December 2025)

-

Total initial allocation: 150,000 $INDEX

-

Optional extension: Up to 3 additional months (Q1 2026)

-

Funding source: Index Coop Treasury

Schedule:

-

Launch: October 14, 2025

-

Reward epochs:

-

Epoch 1: Oct 14 – Oct 27

-

Epoch 2: Oct 28 – Nov 10

-

Epoch 3: Nov 11 – Nov 24

-

Epoch 4: Nov 25 – Dec 8

-

Epoch 5: Dec 9 – Dec 22

-

Epoch 6: Dec 23 – Jan 5

-

Background

The Leverage Suite has been Index Coop’s most successful product line, consistently outperforming other offerings in demand, usage, and revenue generation. This campaign doubles down on that success by expanding visibility, activity, and participation across the suite.

Program Details

Mechanism:

Rewards will be distributed through a raffle system using Merkl.xyz infrastructure. Competition format, entry rules, and reward logic will be defined in the marketing announcement.

Quantum:

A fixed monthly distribution of 50,000 $INDEX, totaling 150,000 $INDEX, funded from the Index Coop Treasury multisig.

Cadence:

Rewards will be distributed in two-week epochs through a prize draw. The first draw covers activity from October 14–27, 2025.

Guardrails:

The program is subject to Index Coop oversight and may be paused or adjusted under the following conditions:

-

Detection of Sybil or gaming behavior.

-

Unexpected market impact on $INDEX price or liquidity linked to reward activity.

-

Insufficient improvement in activity, volume, or TVL after three epochs.

-

Any unforeseen issue that warrants early suspension in the best interest of the protocol.

Rationale

Objective:

Increase trading volume, user engagement, and TVL across the Leverage Suite. Strengthen liquidity and reinforce Index Coop’s position in onchain leveraged exposure.

Trade-offs:

The program temporarily increases token emissions but is limited and time‑bound. The 150,000 $INDEX allocation is a controlled incentive aligned with growth objectives. Guardrails ensure flexibility and operational discipline.

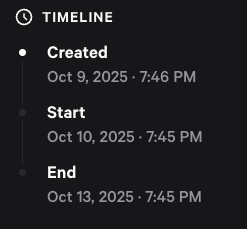

Timeline (UTC)

-

Forum post: October 7, 2025

-

Snapshot: Opens 24 hours later; 48-hour voting window

-

If approved:

-

Launch: October 14, 2025

-

Reward epochs: Oct 14 – Jan 5

-

Extension review: January 7–10, 2026

-

-

Post-program review: By January 15, 2026, summarizing participation data, reward distribution, and performance metrics. Any extension follows this review.

Specification / Execution

Source of funds: INDEX held in the Index Coop Treasury multisig

Action:

Transfer 50,000 $INDEX per month from the Treasury to the Merkl.xyz distribution contract for eligible Leverage Suite participants.

Program extension clause:

After the initial three months, results will be reviewed. If performance meets expectations, the program may be extended without further community approval.

Unclaimed rewards:

Unclaimed or undistributed rewards will be clawed back to the Treasury. If the recovered amount is sufficient, tokens may be redeployed at discretion to extend the campaign or fund additional epochs.

Communications:

-

Announcement: October 14, 2025

-

Competition and eligibility details published in the marketing announcement

-

Biweekly updates on participation and results

-

Final review by mid-January 2026

Voting

FOR — Approve the INDEX Leverage Suite Incentive Program distributing 50,000 $INDEX per month (150,000 total) from the Treasury in two-week epochs for three months (October 14, 2025 – January 5, 2026).

AGAINST — Do not launch the Leverage Suite Incentive Program.