The purpose of this post is to quickly share some distribution notes about the Coop’s 2nd product, the CGCI-LV, so that the community can stay informed and can critique and/or help where applicable in preparation for the upcoming launch. This is just a quick summary of some notes we are preparing for the launch of the CGCI-LV and would welcome any feedback!

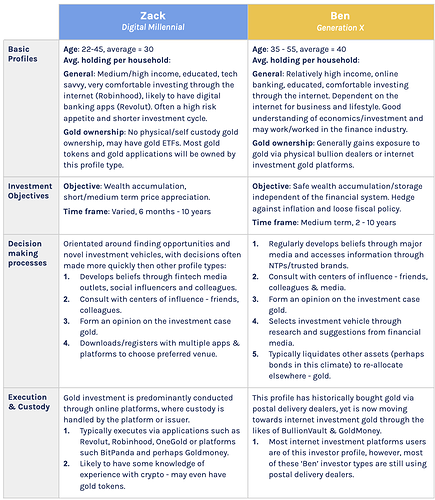

The CGCI-LV currently has 5 key Target Markets (Sound Money Crypto, Internet Investment Gold, Crypto Portfolio Builders, Crypto Treasury Funds and Private Banks / Asset Managers) which we breakdown below.

1. Sound Money Crypto

- Sound Money Crypto investors are fundamentally self directed investors who have purchased bitcoin, and/or Ether, primarily because of the sound money qualities attributed to it.

- The sound money qualities of hard assets, such as gold, makes CGCI-LV a potentially compelling product for this type of investor.

- There are approximately 63,000 bitcoin investors that are deemed to belong to sound money motivated investors and own wallets in the region of 1-1000btc.

- The target wallet for this market is estimated to be approximately $1.85b.

Value propositions:

- Long term value

- Systemic Hedge

- Strategic allocation (diversification)

- Ability to invest in sound money assets (gold and crypto) in a digital and easily accessible format.

Distribution Venues:

- Brian and Christopher’s are on major crypto exchange venues (e.g., Kraken, Coinbase, Blockchain.com, etc.)

- Brian’s can also be found on DEX’s and major wallets

2. Internet Investment Gold

-

Internet Investment Gold refers to gold that is sold via the internet and stored on the investor’s behalf, excluding ETFs.

-

The competitive advantages and innovation behind the CGCI-LV make it a potentially compelling product for investors in this market.

-

Estimates suggest the total value of gold held on internet gold investment platforms equates to roughly $7.4bn, across 390k decision makers. The target wallet for this market is estimated to be approximately $7.4bn.

Value propositions:

- Long term value

- Systemic Hedge

- Strategic allocation (diversification)

- Innovating and interesting

- Ability to Generate Yield on Investment

Distribution Venues:

- Product integration with online gold platforms (e.g., Goldmoney).

- Pushing qualified clients to easy to use crypto platforms, like Coinbase and Blockchain.com, once CGCI-LV is listed.

3. Crypto Portfolio Builders

- Crypto portfolio investors are self-directed investors who have purchased bitcoin and/or Ether as part of a wider portfolio of cryptoassets.

- The similarities between gold and bitcoin make CGCI-LV a potentially compelling product for this type of investor.

- There are approximately 304k crypto investors that are deemed to be portfolio builders and own bitcoin wallets in the region of 0.1-10btc.

- The target wallet for this market is estimated to be approximately $534m.

Value propositions:

- Risk-controlled, long term value

- Strategic allocation (diversification)

- Ability to minimize risk in a crypto portfolio and to build up a structured investment portfolio.

Distribution Venues:

- DEX’s

- On-ramp crypto wallets (e.g. Dharma)

- Estimates below for addressable market at the following exchanges:

4. Crypto Treasury Funds

- Crypto treasury funds control and manages the Foundation’s assets. For the most part, the Foundation’s investment thesis is to preserve wealth via risk-controlled investment vehicles. Offering a product that is crypto native in the form of an ERC-20 token makes things easier for a Foundation to consider.

- Given the robust structure of the CGCI-LV and being aligned with wealth preservation using cryptoassets, treasury funds is a natural fit. Also, the index has sophisticated research backing the product which is standard for any investment committee.

- E.g., Dash Investment Foundation allocated a portion of their funds in a similar strategy to the CGCI-LV. This proves fit for the product in other treasury funds. See here: https://cointelegraph.com/news/dash-investment-foundation-buying-gold-as-part-of-rebalancing-strategy

5. Private Banks / Asset Managers

- Private banks and asset managers are looking for alternative investment products to offer to their clients, primarily digital assets. A product that blends gold with crypto, in a risk-controlled manner, is very compelling and would be well-received.

- Discussions have already began with this target market and there is interest for the product.

Next Steps:

- The CGCI-LV will execute upon each target market in coordinated steps. Initially starting with Crypto Portfolio Builders and Sound Money Crypto, followed by Crypto Treasury Funds, PB’s/AB’s and finally, IIG.

- There are still a few necessary steps to complete before launch, such as preparing liquidity, finalizing product content, website material, and marketing material.

- Following launch, the CGCI-LV will begin integration discussions with notable partners that are associated with each target market to help access the clients and further our distribution capabilities. This includes exchanges, wallets, lending platforms, and more.

they would probably want to vet the system, and they would need price feeds. So still early

they would probably want to vet the system, and they would need price feeds. So still early