IIP: 137

Title: Launch Play-to-Earn Gaming ($P2E)

Status: Proposed

Authors: @seb , @JosephKnecht (Index Coop, MoonRock )

Reviewed by: @DocHabanero

Gov Review: @sixtykeys

Created: 3rd Feb 2022

Modified: 7th March 2022

1.0 Simple Summary

The Product Pod proposes launching a Play-to-Earn Gaming index token (P2E), a thematic index for investors seeking passive exposure to blockchain gaming.

Note, P2E will initially launch on Ethereum mainnet, however we seek to launch native gaming indexes across Alt-L1’s as the gaming ecosystem matures. Non-Ethereum based compositions will be referred to throughout this post as P2E-A for Avalanche P2E-A, P2E-B for Binance, P2E-H for Harmony, P2E-F for Fantom, P2E-S for Solana and P2E-P for Polygon. This post is seeking blanket DG approval for all P2E implementations across chains.The launches on the non-mainnet chains will be exchange issuance only with no need for seed liquidity.

2.0 Abstract

P2E is a thematic index token that captures exposure to play-to-earn gaming, the infrastructure that enables it and guilds who implement yield-generating strategies across play-to-earn games.

3.0 Motivation & Rationale

Play-to-earn is the idea that normal people can earn money playing digital games. The immutable, permissionless and composable characteristics of NFTs allow for video game players to own their in-game digital assets. In other words, NFTs allow the 2.69 billions people who play video games an opportunity to capitalize on what they do for fun. We believe that we are in the early stages of zero-to-one moment for the gaming industry. P2E seeks to identify and invest in the most innovative protocols advancing play-to-earn and player owned ecosystems. Lastly, in Index Coop’s most recent market research survey from Dec 2021, launching a Gaming Token resulted in the most requested product with over 24% of participants requesting it followed by a metaverse index (21%), and an NFT index (14%).

4.0 Specification

4.1 Overview

P2E consists of a basket of ERC-20 tokens which seek to capture exposure to the gaming ecosystem across play-to-earn, infrastructure, and guilds sectors.

4.2 Differentiation

P2E differs from existing gaming/metaverse in that we believe gaming crypto space is best captured by focusing on three core investment categories:

- Play-to-earn games - pioneered by Axie Infinity, on chain games leverage NFTs providing players with true ownership of in-game assets

- Guilds - deploy a number of yield-generating strategies across gaming economics, such as scholarships and investments in core game assets

- Gaming Infrastructure - from specialized blockchains for gaming to platforms that drive gaming ecosystems gaming infrastructure is pivotal to the growth of play-to-earn

Gaming/metaverse index tokens currently on the market include MVI, GAME, PLAY, NFTI and META.

Regarding MVI, at the moment the P2E and the Metaverse (MVI) index share eight of the thirteen tokens and 80% of the market cap. However, P2E only shares three of the nine categories MVI considers for token inclusion. We believe as the gaming and metaverse ecosystems mature there will be a significant divergence between collectables, virtual worlds, NFTs to name a few of MVI’s composition focus and P2E core crypto gaming strategy.

The recently launched MetaPortal Gaming Index (GAME) shares P2E’s goal of providing exposure to crypto gaming space. They however differ in the composition methodology and are expected to diverge as the industry matures. P2E and GAME share 10 of 13 tokens and 91% of each other’s market cap. Sipher (SIPHER), ParagonsDAO (PDT) and Fancy Games (FNC) were excluded from the P2E index as they did not meet market cap requirements. In addition WILD was also excluded as it did not meet roadmap requirements for the gaming component of the protocol. Enjin Coin (ENJ), Worldwide Asset eXchange (WAXE) and GuildFi (GF), significantly important infrastructure and guild by market cap, are included in P2E and not on GAME’s composition.

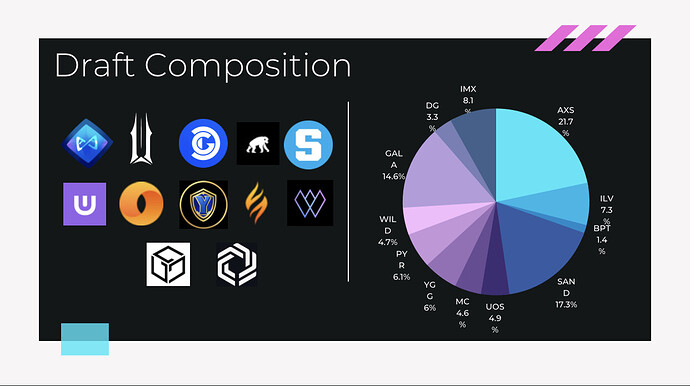

4.3 Example composition

Example composition as of February 2, 2022.

Defi Kingdoms (JEWEL) is expected to be launched as a token within P2E-A, an Avalanche native gaming index.The Overallocation Factor (aka Overanalyser Factor) is the ratio between the allocation for a hypothetical $1M AUM and the trading depth . According to the Liquidity Manifesto, OA Factors greater than 1 for >5% positions suggest a heavy allocation relative to the available underlying liquidity.

5.0 Size of Opportunity

P2E taps into the $173.7B gaming industry. With over 2.69B users, gaming has become one of the fastest growing media sub-segments. 74% of all gaming revenue was generated through in-game transactions by players. This indicates a general willingness for players to spend on in-game items. NFT’s introduce the ability for players to convert the $121.6B spent on in-game items today into productive assets.

The most prominent example of growth of play-to-earn can be visualized by Axie Infity’s $1.3B generated in revenue. Etherium is the only other protocol, blockchain, dapp to have generated more revenue.

We expect P2E to reach $4.8M, $48M and $480M AUM at 1, 12 and 24 months. Our forecast methodology is as follows:

% requested in most recent IC survey * current IC AUM * Average growth for IC products

Where

“% requested in most recent IC survey” is 24%

“current IC AUM” is $200M

“Average growth for IC” is 10X

Gaming market assessments

6.0 Market & Customer Research

6.1 Target Customer

The primary customers for P2E are passive retail investors seeking exposure to the play-to-earn gaming sector.

In primary market research completed by Index Coop (20 Dec 2021), a gaming index was the most-requested product (24%), followed by a metaverse index (21%) and an NFT index (14%).

6.2 Example user stories

As a retail customer, I want one-click exposure to the play-to-earn gaming ecosystem without having to research what protocols to invest in.

As a gaming enthusiast, I believe in the growth of play-to-earn and seeking an investment opportunity that captures exposure across the entire sector.

7.0 Methodology

7.1 Initial Composition & Token Inclusion Criteria

Selection criteria for tokens include:

- Protocols must be within the play-to-earn games, guilds, and gaming infrastructure sectors

- Pre-launch protocols must have a product roadmap with target milestone dates

- Market cap (circulating) > $75M

- Trading depth > $15k non-aggregated @ 100 bps excluding LP fees

- ERC-20 standard

7.2 Weightings

The weighting is 75% square-root market cap and 25% liquidity. Liquidity is defined as the non-aggregated trading depth at 100 bps excluding LP fees.

7.3 On-Chain liquidity analysis of underlying tokens

See composition above.

7.4 Maintenance

The index will not rebalance and will be adjusted following the above token inclusion criteria. No recomposition will be done in the first 12 months.

8.0 Costs

8.1 Cost to customer

P2E is expected to have a 2.95% management fee and a 0.5% mint/redeem fee.

8.2 Cost transparency

The total cost to the customer will be disclosed including the actual and predicted annualized asset decay.

8.3 Rebalance frequency

The index will not rebalance. In the event protocol fails to meet the index methodology we will re-evaluate if a recomposition will be required. In addition, recomposition will be evaluated as new protocols meet the index composition set forth above.

8.4 Product Economics

At month 12, we estimate monthly revenue of $118,000 and gross profit margin of 100% due to the index not rebalancing. This is based on $48M AUM at 12 months, no rebalancing, no recomposition of the index within the first year, a 2.95% streaming fee, and not including liquidity mining incentives.

8.5 Profitability Analysis

8.6 Backtest results

Backtest results for the period April 01, 2021 to Feb 15, 2022. The backtest results for P2E (blue) are shown relative to Ether (red). P2E would have returned 323% compared to 66% for ETH.

8.7 Fee split

Fee split to follow “in-house” methodologist framework where 100% of the income will go to Index Coop with 3% directed to the Product Designer, 5% to the Quantitative Analyst, and 2% to the Product Pod.

8.8 Meta / intrinsic productivity

Metagovernance will be enabled.

Intrinsic productivity will be enabled when it becomes available at Index Coop.

9.0 Liquidity

Liquidity Parameters:

| Target Access Cost % | 2.00% |

|---|---|

| ETH/USD Price | $3,000 |

| Gas Price | 65 gwei |

| Exchange Issuance Gas Required | 2,190,000 wei |

| Exchange Issuance Gas Cost | $427 |

| Total Baseline Liquidity | $4,483,185 |

| Concentration - Lower Bound | -38% |

| Concentration - Upper Bound | 60% |

| ETH Required | 156 |

| Tokens Required | 4,695 |

| Total USD Required | $938,916 |

10.0 Author Background and Commitment

The Product Pod is composed of interdisciplinary contributors who are dedicated to the creation, management, and growth of curated crypto index products.

@seb: Product Designer

@JosephKnecht: Quantitative Analyst

11.0 Marketing support / distribution / partnerships

Marketing and distribution will be supported by Index Coop and follow our internal GTM playbook.

Addendum for P2E-A

Native Composition on Avalanche

Simple Summary

In addition to the P2E index on Ethereum mainnet, we are proposing to launch a P2E index called P2E-A native for the Avalanche ecosystem. By adding P2E-A to the above proposal, we are aiming to streamline our approval process and support a multi-chain deployment strategy.

Abstract

Avalanche is rapidly emerging as a preferred network for gaming due to the fast transaction speed and low costs. P2E-A will allow us to exploit the rapid growth of gaming protocols on the Avalanche network. The project is being developed jointly and with input from Ava Labs.

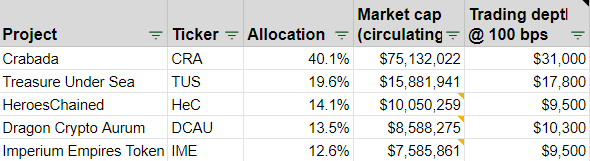

Example composition

Below is a sample composition within the Avalanche ecosystem.

DeFi Kingdoms (JEWEL), Crystalvale (CRYSTAL), and Chain Guardians (CGG) will soon be added to the Avalanche network. We plan to add these tokens prior to launch.

Methodology

Initial Composition & Token Inclusion Criteria

Selection criteria for tokens include:

- Protocols must be within the play-to-earn games, guilds, and gaming infrastructure sectors

- Pre-launch protocols must have a product roadmap with target milestone dates

- Market cap (circulating) > $5M

- Trading depth > $9k non-aggregated @ 100 bps excluding LP fees

- On Avalanche network

Weightings

The weighting is 75% square-root market cap and 25% liquidity. Liquidity is defined as the non-aggregated trading depth at 100 bps including LP fees.

Revision history

February 3, 2022 - Initial forum post

March 7, 2022 - Revision for DG2

Copyright

Copyright and related rights waived via CC0.