Authors : @Louisaraj @sriram @pujimak_in

Co-Authors & Reviewers: @tudou @vanita @mringz

Background :

Since the launch of Index Coop over a year ago - our mission remains the same; to make crypto simple, easy & accessible to all. This sense of direction has shaped how we approach every aspect of the DAO, from growth via engaging in strategic partnership, to finding external methodologies where we deploy products that have excellent product-market fit. We’ve also ventured into creating solutions that make crypto investing simple, by having our products in Layer 2 solution with Polygon, which is a huge win in 2021. Furthermore, creating opportunities for global expansion has resulted in us having the first regional working group, APWG.

Where our principles have been our foundation - our mission has been the compass for growth. As Index Coop moves towards a DAO that is chain agnostic, this post aims to showcase to the community where our next 100x expansion potentially might be. I.e. expanding to the BSC ecosystem.

1. BSC Ecosystem

Binance Smart Chain (BSC) is a hard fork of the Go Ethereum (Geth) protocol, and as such, shares many similarities with the Ethereum blockchain. However, BSC developers have made significant changes in some key areas. The largest change is BSC’s consensus mechanism, which allows for cheaper and faster transactions. Hence, BSC is popular amongst price sensitive users especially in APAC.

2. Blockchain Traffic

A. Avg. daily transactions

There is a major difference between the average daily transactions on BSC and Ethereum. On BSC, it is quicker and more efficient for users to move their funds and interact with smart contracts. BSC’s average daily transaction peaked at 13 mil and the current status at over 6M. On the other hand, Ethereum’s daily transactions have never exceeded 1.7M.

Source: bscscan.com

Source: etherscan.com

B. Active Daily Address

Despite being a newer blockchain, BSC recorded a high of 1.5 mil addresses on Oct 14, 2021 – more than double Ethereum’s all-time high of 799,580 addresses on May 9, 2021.

Source: bscscan.com

Source: etherscan.com

C. Unique Wallet Addresses

The number of unique wallet addresses on BSC has hit 116m since its inception.

Source: bscscan.com

D. Total Value Locked

Among the top L1 chains, BSC occupies the second position with TVL of $19.47B and has witnessed tremendous growth since its launch in September ‘20

Source: Defillama

3. Defi Dapp Comparison

A. Trading volume

PancakeSwap, the largest DEX for the BSC ecosystem, at time of writing has recorded USD 1.3B in 24hr trading volume and is ranked number one in overall performance of DEX trading volume for all blockchain among all DEXs.

DEX Trading Volume Ranking

Source: Debank.com

It is interesting to note the average size of trade for users from PancakeSwap (24H VOL/ 24H USERS) averages to approx. USD 2400. This could be an indication that most users on BSC are new to crypto trading and investing. Listing Index Coop’s products on BSC would further align with the mission to be the landing spot for millions of crypto investors all around the world as they start investing in this space.

B. DEXes TVL Comparison

PancakeSwap is ranked third in overall DEXes TVL with USD 6B deposited in the protocol. A point to note is Pancakeswap has only presence on BSC.

Source: Defillama

C. Pancakeswap demographics

Pancakeswap has a strong presence and caters widely to Asian countries and has Japan & India as its top users. Also note that among the top 10 list below, 3 of them are in Americas region, with the US actually taking the top spot, and the 2 countries in the LATAM region accounted for almost 12.2%, shy of 3% from the US . This is only one of the indicators that despite strong presence in Asia + Pacific, it also adds a lot of value to both developing and developed countries.

Source: Webrate.org

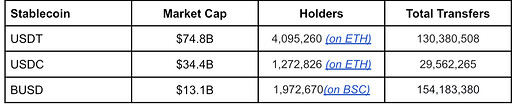

4. Stablecoin holders comparison

Stablecoin is one key factor in driving mass adoption of crypto as it serves as the bridge between fiat and crypto. BUSD is a 1:1 US dollar-backed stablecoin issued by Paxos and approved by the New York State Department of Financial Services, and is the major stablecoin for the BSC ecosystem. At time of writing, there are currently 1.97 mil wallet addresses that are holding BUSD. This is also the second most held stablecoin in terms of token holders. This means that a significant number of crypto users trust BUSD as the stable coin of choice for Defi solutions.

5. Competitors to Index Coop in BSC Ecosystem

In summary, there are no strong competitors in the field of crypto index products in BSC ecosystem.

6. Potential of BSC for IC

- Since BSC is strongly backed by Binance, there is a constant influx of new users of Binance Centralized Exchange onto BSC as it is their primary DeFi chain.

- Binance is further strengthening BSC with a new 1B [growth fund ](https://www.binance.org/en/blog/binance-launches-one-billion-binance-smart-chain-fund-to-reach-one-billion-crypto-users/)across the ecosystem

- BSC is dominated by Asian markets which could be a potential target of IC’s next billion users, so having a brand presence on BSC could aid in the same

- While BSC is dominant in emerging markets, one cannot deny that even in developed nations, especially the United States; they are also one of the key stakeholders that use this chain in the DeFI space

Conclusion:

Index Coop is only as strong as its overall presence in the whole DeFI space. Having our products across multiple chains while maintaining its strong commitment to product growth, protocol sustainability and community autonomy will enable us to move one step closer to our mission of making crypto investing easy, simple & accessible. As we experiment on having our products across multiple chains, it is important to prioritise our efforts on one that will return the greatest impact to our core KPIs. Given the metrics above which highlights the performance of BSC, we believe that expanding our products to BSC is an experiment worth having. We value community feedback on the 2nd largest ecosystem (after ETH) research and we look forward to your inputs & suggestion.

Please share any comments/questions/objections/concerns you have below!

Temperature check;

- FOR - having our products on BSC can add FURTHER value to Index Coop; more R&D required to address benefits & challenges moving forward.

- AGAINST - having our products on BSC will NOT add value to Index Coop; cease R&D and proceed in other endeavours.

0 voters