Operations Account

Contributors: @dylan @DarkForestCapital @verto0912 @Lavi @MrMadila @AcceleratedCapital @george @ggraham1

Summary

We introduced the concept of the Operations Account earlier this month in the Treasury Diversification post. In this post, we will summarise all Index Coop’s initiatives and how they relate to the Operations Account. In doing so, we receive income, pay expenses and intend to support the following initiatives being considered by Index Coop.

- Methodologist Rewards

- Smart Treasury

- Liquidity Mining Framework

- Full Time Employee Package

- Distribution of Community Rewards in Stable Coins, wETH & INDEX

- Contributor Token Ownership Plan

- KPI Rewards Program

- Governance Mining

- Working Groups

This document presents a holistic overview of how all the topics mentioned above come together. It is not easy reading many posts and piecing it all together. So hopefully, by the end of this piece, we all have a basic understanding of each initiative that is being considered.

Methodologist Rewards

Strong partnerships with strong methodologists bring strong products, credibility, brand recognition and distribution. Our ability to coordinate with some of the most brilliant minds in the industry and work on launching innovative products together drives our success and differentiates us from the competition. In an effort to attract the best partners, Index Coop has active Methodologist incentives comprising 7.5% of all INDEX tokens that will be distributed over an 18 month period.

Liquidity Mining

Liquidity Mining is used to bootstrap market liquidity during the launch phase of a product’s life cycle. Liquidity Mining is used to incentivise deeper pools of liquidity, leading to low slippage, efficient market dynamics and overall better user experience. The Liquidity Mining Framework post provides structure for how to successfully plan a liquidity mining campaign and transition a product from the launch to growth phase.

Full Time Contributor Retention

Critical to the long term success of Index Coop, we have a clear framework for how we reward and retain our full time contributors. Details of this can be found here.

Distribution of Community Rewards

Recent on and off chain analysis shows around 40% of all INDEX contributor rewards are sold shortly after being received. The retention rate is potentially indicative that rewarding contributors in INDEX tokens is not optimal for some members. The recent survey confirms that a large portion of contributors receiving rewards, would prefer some level of non INDEX payment. When additional engineering resources are available and the treasury can support these assets, we intend to revisit this initiative.

Contributor Token Ownership Plan (CTOP)

The CTOP incentive scheme gives Bronze, Silver and Gold contributors who receive rewards in INDEX the ability to increase their ownership over time. As a DAO we find ourselves with a key group of dedicated contributors that have relatively little collective ownership. Whilst the CTOP will not solve this issue, it does enable contributors to join Index Coop and build ownership over time. Community Contributors are able to vest community rewards for a set period of time (ie: 2-3 months) and receive a multiplier (x1.3). The details are very much under review, the numbers given are examples and we look forward to presenting an iteration of an earlier post seen here.

This proposal enables Bronze, Silver & Gold Owls to build further ownership in something they believe in overtime.

KPI Rewards Program

Having a reward mechanism that motivates, drives and rewards contributors for achieving ambitious growth goals is great for building DAO culture.

Index Coop is exploring various ways to reward contributors for reaching our growth targets. One mechanism being considered is UMA options. The intent is to financially motivate and reward contributors for achieving our KPIs.

DeFi is incredibly competitive in many ways and Index Coop wants to capitalise on this market cycle to maximise its potential. With ambitious growth objectives, a rewards incentive program creates an economic motive for the community to achieve our goals.

INDEX Liquidity / Smart Treasury

Index Coop is already able to convert income from various products to ETH via the respective Product-ETH pools (mint/redeem functionality) and is in need of a highly liquid market to convert ETH to INDEX. A highly liquid INDEX-ETH pool gives the Operations Account the ability to reliably convert some/all income sources into INDEX. Currently, the preferred option for achieving this is a Smart Treasury via a 80/20 INDEX-ETH Balancer smart pool. However, in light of how IIP-32 progresses, depositing into a traditional 50/50 pool may become more appealing in the short term.

As our income grows, so will the buy side pressure on INDEX, which acts to provide some support for the token price over time. There is also the added benefit of providing liquidity for the INDEX token from the Treasury and receiving trading fees from the pool. Over time, the INDEX tokens purchased on market from fees are intended to fund the Index Coop’s Operational expenditure.

The Smart Treasury is income generating, supports INDEX price and gives us a solid secondary market to convert our various income streams to INDEX for funding our long term operating expenses. An additional benefit is the 80/20 split means a lot of INDEX we currently hold becomes productive, earning trading fees and we offer the ability for large traders to buy a sizeable parcel of INDEX tokens on market.

Governance Mining

The Index Coop does a lot of voting! Way more than every other DAO when we consider all the metagovernance voting. To be successful, we need a good voter turnout and sensible voting. Other DAOs with the same issue are beginning to incentivise voting and these DAOs don’t have the metagovernance influence Index Coop has.

We propose implementing governance mining whereby INDEX token holders who vote are rewarded for doing so. Not only does our metagovernance presence become stronger with larger participation, INDEX holders can now earn yield and have the ability to delegate their vote.

This proposal will drive engagement and help us build a metagovernance powerhouse!

Working Groups

Index Coop utilises a working group model and these groups shall have their own budget funded from the Operations Account. For details on how working groups are to be set up, see the forum post. All day to day expenses are to be funded via working groups. A great example is the Growth Working Group proposal.

Conclusion

Each one of these initiatives brings us closer to realising our North Star and KPI goals whilst decentralising our token distribution. We seek the best partners, contributors and strongest metagovernance the ecosystem has to offer. We have a lot of INDEX to distribute and ambitious growth plans over the years to come. To achieve our goals, we need a structure that attracts the best talent and keeps it. To reach our fullest potential we need an active, engaged and vibrant community that thinks/acts like owners do, with vision and drive. Collectively, these initiatives are sustainable, offer something for all contributors and over time, will help Index Coop continue to build a moat which will be envied by all of DeFi.

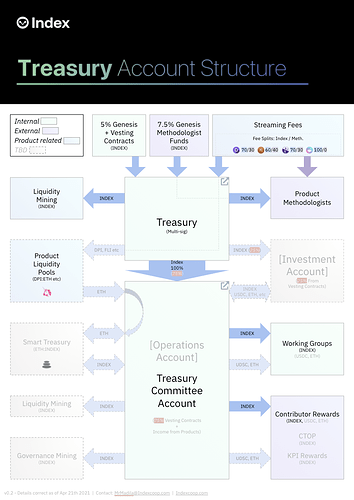

The infographic below shows at a high level what our current structure is and what we think it could look like in the future. The dark text is now and the light text is what the future could hold.

Please see page 2 of the PDF found on the TWG Gitbook page here for more details as well as working links to etherscan.

Treasury Account Structure.pdf (160.1 KB)